- Introduction: Matter of S- Inc., Adopted Decision 2018-02 (AAO Mar. 23, 2018)

- Factual and Procedural History: Page 1, 2-3

- Understanding the Prohibition on Multiple Filings by Related Entities: Page 1-2

- New Rule on Multiple Filing Bar: Pages 3-4

- Applying Rule to Instant Case: Page 4, 5

- Conclusion

Introduction: Matter of S- Inc., Adopted Decision 2018-02 (AAO Mar. 23, 2018)

On March 23, 2018, the United States Citizenship and Immigration Services (USCIS) designated a decision of the Administrative Appeals Office (AAO) as an “adopted decision.” The decision, Matter of S- Inc., Adopted Decision 2018-02 (AAO Mar. 23, 2018) [PDF version], addresses the definition of “related entities” in the H1B petitioning context. The AAO clarified that the term “related entities,” as found in 8 CFR 214.2(h)(2)(i)(G), “includes petitioners, whether or not related through corporate ownership and control, that file cap-subject H1B petitions for the same beneficiary for substantially the same job.” In cases where related entities file multiple petitions for the same H1B beneficiary, the USCIS will revoke the approval of all such cap-subject petitions “[a]bsent a legitimate business interest to file multiple cap-subject petitions for the same beneficiary.”

In this article, we will examine the factual and procedural history of Matter of S- Inc., the AAO’s reasoning and decision, and what this decision will mean now that the USCIS has adopted it as binding policy guidance.

As an adopted decision, Matter of S- Inc. constitutes binding policy guidance on all USCIS employees. To see our articles on other adopted decisions that are currently in effect, please see our index [see index]. Adopted decisions are distinguishable from immigration precedent decisions, although the effect on USCIS employees is similar. Please see our index of immigration precedent decisions, including AAO decisions that have been selected for publication, to see our myriad articles on this subject [see index].

Factual and Procedural History: Page 1, 2-3

The Petitioner was a software development and consulting firm. It sought H1B classification for the Beneficiary, looking to employ the Beneficiary as a “programmer analyst.”

The petition had been approved by the USCIS. However, subsequent to the approval, the Director of the USCIS Vermont Service Center issued a notice of intent to revoke (NOIR) the petition. In the NOIR, the Director found that the Petitioner and C-LLC, another entity that had also filed a cap-subject H1B petition on behalf of the same Beneficiary, were “related entities.” The NOIR added “that the petitions were filed during the same fiscal year for the same Beneficiary to work in substantially the same job for the same end-client through the same two vendors.” To this effect, the NOIR noted that both petitions contained identical letters from the end-client and vendors. Furthermore, the petitions contained similar descriptions of the intended position and nearly identical evidence for the Beneficiary.

We discuss the prohibition on multiple H1B filings for the same beneficiary by “related entities” in the next section [see section].

In response to the NOIR, the Petitioner denied that C-LLC and it were “related entities” as defined in 8 C.F.R. 214.2(h)(2)(i)(G). In support of the claim, “[t]he Petitioner submitted separate articles of incorporation, corporate by-laws, stock certificates, stock transfer ledgers, operating agreements, federal employer identification (FEIN), federal tax returns, and leases for its company and C-LLC.” In addition, the Petitioner submitted proof that C-LLC had withdrawn its petition for the Beneficiary in the form of a USCIS notice. The notice specified that C-LLC had withdrawn the petition after the Director’s initial approval of Petitioner’s petition.

After reviewing the response to the NOIR, the Director revoked the approval of the petition. In the revocation notice, the Director acknowledged that the Petitioner and C-LLC had “separate FEINs, operation locations, management, and ownership.” Furthermore, the Director found that the Petitioner and C-LLC did not have a parent, subsidiary, or affiliate relationship. The Director based the decision to nevertheless revoke the petition on the fact that the similarities between the petitions — notably the fact that they were for the Beneficiary “to work substantially the same job at the same end-client” — established that the Petitioner and C-LLC were “related entities” for purpose of the 8 C.F.R. 214.2(h)(2)(i)(G) filing bar.

The Petitioner appealed from the Director’s decision to the AAO, arguing that the Director erred in finding that it and C-LLC were related entities. The Petitioner argued that the scope of the term “related entities” only encompasses “entities that are related through corporate ownership and control” (AAO description of argument).

For the forthcoming reasons, the AAO dismissed the appeal in a non-precedent decision issued on January 11, 2018. The initial decision had no binding effect outside of the facts of the instant case. However, the AAO would reopen the decision on its own motion under 8 C.F.R. 103.5(a)(5)(i) for the purpose of making revisions for adoption by the USCIS.

Understanding the Prohibition on Multiple Filings by Related Entities: Page 1-2

Because there is more demand for H1B visas than there are available H1B visas, the USCIS conducts a random lottery of cap-subject H1B petitions received by a certain date. The statutes for the annual H1B cap are found in sections 214(g)(1), (5)(C) of the Immigration and Nationality Act (INA). The AAO noted that the H1B lottery may incentivize petitioners to “sometimes try to improve their chances of winning the initial lottery selection by submitting multiple petitions on behalf of the same beneficiary without a legitimate business need to do so.” It is for this reason that the USCIS promulgated regulations providing for the revocation of all H1B petitions filed for a common beneficiary by the same employer or by “related entities” to that employer if the multiple petitions were filed without a “legitimate business need.”

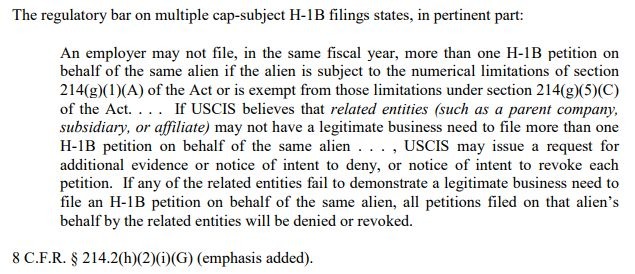

The regulation penalizing filings by related entities is found in 8 C.F.R. 214.2(h)(2)(i)(G). The AAO excerpted the pertinent part of the regulation as clipped below:

The AAO’s task in the instant case was to define the scope of the regulatory term “related entities.” Specifically, as the AAO explained, “[t]he … scenario gets more complicated when, as here, a petitioner demonstrates that it is not ‘related’ to the other employer through corporate ownership and control, but other factors evident from the record nonetheless demonstrate the existence of a relationship.”

New Rule on Multiple Filing Bar: Pages 3-4

The AAO concluded that the Director properly revoked the approval of the petition on the basis of the conclusion that the Petitioner was a “related entity” to C-LLC for purposes of the 8 C.F.R. 214.2(h)(2)(i)(G) multiple filing bar. It found that the Petitioner’s narrower reading of the multiple filing bar as applying only to entities that are related through corporate ownership or control was incorrect. Specifically, while the regulation only specifies the relationships of “parent company, subsidiary, or affiliate,” the AAO noted that this list was prefaced by the phrase “such as,” which “does not circumscribe a closed set of relevant relationships.” In other words, the AAO read the regulation as providing a non-exhaustive list of examples of “related entity” relationships rather than a closed set of all such relationships. In addition to not comporting with the text of the regulation, the AAO also concluded that the Petitioner’s reading “would frustrate the regulation’s purpose of promoting fair access to limited visas.”

The AAO held as follows: “[W]e construe ‘related entities’ to include petitioners, whether or not related through corporate ownership and control, who submit multiple petitions for the same beneficiary for substantially the same job.”

The Board explained that the question of whether two jobs are “substantially the same” is a question of fact that is adjudicated based on the totality of the record.

The AAO then addressed determining “relatedness” between two entities. To this effect, the AAO provided the following non-exhaustive list of factors that should be considered where applicable:

Familial ties;

Proximity of locations;

Leadership structure;

Employment history;

Similar work assignments; and

Substantially similar supporting documentation.

The AAO noted that “the more similarities in the records [between two petitions], the more likely the companies were seeking to undermine the purpose of the random lottery process.”

The AAO rejected the Petitioner’s concerns that this reading of the regulation would ensnare unrelated entities filing separate petitions on behalf of the sane Beneficiary. Here, the AAO stated that its reading would not affect petitioners who lack “any quantum of a relationship.” It added that “[t]wo unwitting companies would not likely have the requisite similitude to trigger the bar.”

In the event that two entities are found to be related, the adjudicator must determine under 8 C.F.R. 214.2(h)(2)(i)(G) whether the petitioner(s) demonstrated “a legitimate business need to file more than one H1B petition on behalf of the same” H1B beneficiary. Here, the AAO added in a footnote that the “legitimate business need” only applies in the event that the cap-subject petitions were filed by related entities and not by the same entity.

In order to satisfy the “legitimate business need” standard, the Petitioner must establish that each job opportunity was:

Bona fide;

Available to the beneficiary; and

Materially distinct.

Citing to 63 FR 30419, 30419-20 (proposed June 4, 1998) [PDF version], the AAO made clear that “speculative employment” is not permitted under the H1B program.

Under this standard, the petitions filed by related entities “cannot be offering essentially the same job opportunity to the beneficiary.” Instead, the petitions must specify real job offers that are actually available to the beneficiary and that are materially distinct from each other.

Applying Rule to Instant Case: Page 4, 5

Having set forth its new rule, the AAO moved to apply the rule to the facts of the instant case.

First, the AAO held that the record in the instant case established that the Petitioner and C-LLC were “related entities” under the regulatory standard. The AAO acknowledged that the entities “appear[ed] to stand at arm’s length under corporate law…” However, it agreed with the Director’s findings that the two entities had filed nearly identical petitions to employ the Beneficiary in substantially the same job, which in this case involved “performing substantially similar duties for the same end-client,” and that this sufficed to conclude that they were “related entities.” The AAO added that C-LLC’s petition even “contained a copy of its Subcontractor Agreement with the Petitioner — executed less than one month before the instant H1B petition was filed.”

The AAO then assessed whether there was a “legitimate business need” for the Petitioner and C-LLC to file multiple petitions on behalf of the same beneficiary. The AAO concluded that there was not, upon finding that the positions proffered were not “materially distinct.” To this effect, the AAO noted that “the petitions were filed in the same fiscal year for the same Beneficiary to work in substantially the same position for the same end-client through the same two vendors.” Furthermore, the AAO noted that the Petitioner had only contested the “relatedness” point and did not seek to establish, in the alternative, that there was a “legitimate business need” for the multiple petitions.

Finally, the AAO concluded that “C-LLC’s subsequent withdrawal of its duplicate petition for the Beneficiary did not absolve the Petitioner of the multiple filing bar.” Here, the Board explained that the multiple filing bar requires the revocation of “all petitions filed on that alien’s behalf by related entities.”

Conclusion

The AAO’s clarification of the multiple filing bar makes clear that the term “related entities” is not defined solely by a corporate relationship between two entities. Instead, other evidence in the record may establish that two entities that “stand at arm’s length under corporate law” may be nevertheless related. This may be established through substantial similarities between two petitions filed on behalf of the same beneficiary, especially relating to the positions offered and the evidence submitted in support of the beneficiary. In the event that two entities are determined to be related, they must establish that there was a “legitimate business need” for the multiple petitions in order to not be subject to the multiple filing bar.

A petitioner should work closely with an experienced immigration attorney in the area of employment immigration throughout the petitioning process. An experienced attorney will be able to identify potential flaws in the petition, including those related to the multiple filing bar, and advise the petitioner accordingly on the legal requirements of the H1B program.