- Introduction

- Overview of the Major Provisions

- A. Priority Date Retention

- B. Increasing the Minimum Investment Amount

- C. Increasing the Minimum Investment Amount for High Employment Areas

- D. Increasing the Minimum Investment Amount for Targeted Employment Areas

- E. Targeted Employment Area Designation Process

- F. Technical Changes

- Conclusion

Introduction

On January 13, 2017, the Department of Homeland Security published a notice of proposed rulemaking in the Federal Register titled “EB-5 Immigrant Investor Program Modernization” [see 82 FR 4738]. The rule was open for public comment until April 11, 2017. The DHS will examine the comments and incorporate them toward creating a new final rule affecting the EB5 program. The notice of proposed rulemaking proposed changes to key aspects of the EB5 program. In this article, we will examine the significant changes in the notice of proposed rulemaking and discuss briefly what these changes may mean for the future of the EB5 program if they are adopted.

Unrelated to the notice of proposed rulemaking, the EB5 program is slated to expire on April 28, 2017. However, Congress is expected to extend the EB5 program on April 28. We will update the website with more information as the situation develops.

Overview of the Major Provisions

The DHS noted at 82 FR 4743 that it “has not comprehensively revised the EB-5 program regulations since they were published in 1993…” Instead, the DHS has relied on issuing policy guidance in accord with those regulations and the relevant statutes. The DHS explained that the notice of proposed rulemaking is intended to both propose “changes to portions of the EB-5 program that are in need of reform” and to “codify and clarify certain policies.”

In the following sections, we will examine each of the proposed rule changes included in the notice of proposed rulemaking.

A. Priority Date Retention (82 FR 4743-4744)

The notice of proposed rulemaking proposed amending 8 C.F.R. 204.6(d) to allow an EB5 petitioner “to use the priority date of an approved EB5 petition for any subsequently filed EB-5 immigrant petition for which the petitioner qualifies.”

This new priority date retention provision would not apply where the original EB5 immigrant petition’s approval was revoked because the United States Citizenship and Immigration Services (USCIS) had found that it was approved based on fraud or willful misrepresentation of a material fact, or if a determination was made that it had been approved based on a material error. Additionally, priority date retention would not adhere once a petitioner had used his or her priority date to obtain conditional lawful permanent resident (LPR) status on the basis of the approved petition.

The priority date retention provision would apply in cases where an approved EB5 immigrant petition is revoked for reasons other than a finding of fraud, willful misrepresentation of a material fact, or material DHS error. In such cases, the petitioner would still be able to use the priority date from the revoked petition in the event that he or she seeks to file another immigrant petition under the EB5 program. It is important to note, however, that only approved petitions would establish a priority date. Denied petitions would not establish a priority date. Priority dates would not be transferrable to other investors under the new rule.

Under the current 8 C.F.R. 204.6(d), EB5 immigrant petitioners are not permitted to use the priority date of an approved EB5 petition for a subsequent EB5 petition. The DHS explains that the proposed rule “would bring the EB-5 priority date retention policy into harmony with [the EB1, EB2, and EB3] preference categories.”

The DHS listed two main reasons for the proposed rule change:

1. To address situations in which an EB5 petitioner with an approved EB5 petition becomes ineligible for EB5 classification while waiting for his or her priority date to become current due to circumstances beyond his or her control (e.g., the termination of a regional center); and

2. To provide investors with greater flexibility to deal with changes to business conditions.

The DHS determined that this change would be beneficial due in large part to the fact that there is far more demand for EB5 visas than there are available EB5 visa numbers. The proposed rule would promise to give investors facing EB5 backlogs the flexibility to reinvest their funds without losing their place in line for an EB5 immigrant investor visa.

B. Increasing the Minimum Investment Amount (82 FR 4744-4746)

Under section 203(b)(5)(C)(i) of the Immigration and Nationality Act (INA), the minimum investment amount for the EB5 program is set at $1 million. The statute gave the Attorney General (now the Secretary of Homeland Security) the authority to increase the minimum investment amount in consultation with the Secretary of Labor. This authority to increase the minimum investment amount has never been used. The DHS explained in the notice of proposed rulemaking that “over the past 25 years inflation has eroded the present-day value of the minimum investment required to participate in the EB-5 program.”

Accordingly, the notice of proposed rulemaking proposed increasing the minimum investment amount from $1 million to $1.8 million. To ensure that it increases in accord with inflation, the DHS also proposed including a “mechanism for future adjustments every 5 years, based on the CPI-U.” The notice of proposed rulemaking proposes that these amendments be made to 8 C.F.R. 204.6(f)(1).

The DHS proposed the increase in the minimum investment account — based on inflation — “without regard for the amount of capital that would likely be required to fulfill the statutory requirement for 10 jobs.” In defense of its decision, the DHS explained that Congress never set forth that adjustments in the minimum investment amount are related to EB5 job creation.

The DHS explained that the increase would, in its opinion, “both modernize the [EB5] program and ensure a level of capital investment in the United States that more closely adheres to congressional intent.” Furthermore, the DHS took the position that the change would benefit the U.S. economy by increasing the amount of foreign investment in the United States. The DHS also noted that other countries’ investor programs typically have higher investment thresholds, and the proposed change would thus ensure that the EB5 program would remain competitive even with the increase.

The proposed rule would require that each investor be required to contribute the minimum investment amount that is designated at the time the initial EB5 petition is filed. This means that those who have already filed petitions would be unaffected were the change to be included in the final rule.

C. Increasing the Minimum Investment Amount for High Employment Areas (82 FR 4746)

Section 203(b)(5)(C)(iii) of the INA permits the DHS to set the qualifying investment amount for high employment areas to an amount greater than the standard minimum investment amount. However, the DHS may not make the amount more than three times greater the standard investment amount.

The DHS explains that the authority to set a higher minimum investment amount for high employment areas has never been used. Thus, it has always been identical to the standard minimum investment amount. Accordingly, the DHS has not tracked which EB5 investments have been made in “high employment areas.” For this reason, it concluded that it does not have sufficient information to determine whether it should set a higher minimum investment amount for high employment areas.

Accordingly, the notice of proposed rulemaking proposes amending 8 C.F.R. 204.6(f)(3) to make the minimum investment amount for high employment areas identical to the new $1.8 million standard minimum investment amount. All of the same rules and stipulations would apply.

D. Increasing the Minimum Investment Amount for Targeted Employment Areas (82 FR 4746-4747)

Section 203(b)(5)(C)(ii) gives the DHS the authority to set a different reduced minimum investment amount than the standard minimum investment about for investment in targeted employment areas (TEAs). Congress specifically authorized the DHS to set the minimum investment amount for TEAs as low as one-half of the standard minimum investment about. For the entire duration of the EB5 program, the minimum investment amount for TEAs has been $500,000, one-half of the standard minimum investment amount.

The DHS explains that, while Congress may have anticipated that the majority of EB5 petitions would be filed with the regular minimum investment, the vast majority of EB5 petitions are filed based on investments made in TEAs. For example, the DHS cites to statistics from 2015, showing that approximately 97-percent of all investments by EB5 petitioners were made in TEAs for the reduced $500,000 investment amount.

The DHS determined that, based on the overwhelming number of investments in TEAs as compared to investments outside of TEAs, the EB5 program “has failed to strike the balance that Congress appears to have intended by creating a multi-leveled investment framework in the EB-5 program.” Furthermore, the DHS took the position that the differential “has the potential of distorting general market forces and the business decisions that follow from such forces to an unintended degree.”

For this reason, the DHS proposed amending 8 C.F.R. 204.6(f)(2) to make the minimum investment threshold for TEAs 75-percent of the new standard minimum investment threshold. Accordingly, the rule proposed a new $1.35 million minimum investment threshold for TEAs. The DHS would also create the same mechanism for reconsidering the TEA minimum investment threshold that it proposed for the standard minimum investment threshold.

The DHS explained that it considered changing the percentage reduction for TEA investments to various degrees. It settled on a 25-percent reduction for the following reasons:

1. It would significant reduce the potential for unintended distortions in investment decisions;

2. A 25-percent reduction represents the midway point between the maximum allowed by Congress and no reduction at all; and

3. Proposing a new minimum level between the two extremes and putting it forth for public comment was appropriate.

Furthermore, the DHS noted that the difference in real dollars between the standard minimum investment amount and the TEA amount would be nearly identical to what it is currently. The current difference is $500,000, whereas the difference under the proposed new rule would be $450,000.

E. Targeted Employment Area Designation Process (82 FR 4747-4750)

Under section 203(b)(5)(B)(ii) of the INA, a TEA is defined as “a rural area or an area which has experienced high unemployment (of at least 150 percent of the national average rate).” In the current implementing regulations found in 8 C.F.R. 204.6(j)(6)(ii), investors are permitted to demonstrate that their investment is in an area that meets the criteria of a TEA in one of two ways (quoted from the notice of proposed rulemaking):

A. By providing evidence that the metropolitan statistical area, the specific county within the metropolitan statistical area, or the county in which a city or town with a population of 20,000 or more is located, in which the new commercial enterprise is principally doing business has experienced an average unemployment rate of at least 150 percent of the national average rate; or

B. [B]y submitting a letter from an authorized body of the government of the state in which the new commercial enterprise is located which certifies that the geographic or political subdivision of the metropolitan statistical area of the city or town with a population of 20,000 or more in which the enterprise is principally doing business has been designated a high unemployment area.

The DHS explained that the then Immigration and Naturalization Service (INS) decided when promulgating the above regulations in 1991 that states “should have an opportunity to participate in TEA determinations.” This point of emphasis is seen in 8 C.F.R. 204.6(j)(6)(ii)(B). However, the DHS took the position that “[r]eliance on states’ TEA designations has resulted in the application of inconsistent rules by different states.” For example, it noted that some states “may be motivated primarily by the desire to promote economic development … rather than by the desire to fulfill congressional intent with respect to the EB-5 program.” This has resulted in the existence of TEAs “that consist of areas of relative economic prosperity linked to areas with lower employment…”

To remedy the problem, the notice of proposed rulemaking proposed eliminating state designation of TEAs. Under the proposed rule, the DHS would determine which areas qualify as TEAs by applying new standards contained in the proposed rule to evidence presented by petitioning EB5 investors and regional centers. In the alternative, the DHS had considered proposing a rule that would continue to allow states to make TEA designations in accordance with a set of principles that would enable the DHS to scrutinize and overturn state TEA designations. However, the DHS determined that such an approach would be too burdensome and that it would be easier for the DHS to “administer a nationwide standard on its own.”

The DHS’s proposed rules are as follows:

Proposed 8 C.F.R. 204.6(e): The term “targeted employment area” would be defined as an area which, at the time of investment, is a rural area or is designated as an area which has experienced unemployment of at least 150 percent of the national average rate.” Additionally, the DHS also proposed to define “rural area” as “any area other than an area within a metropolitan statistical area (as designated by the Office of Management and Budget (OMB)) or within the outer boundary of any city or town having a population of 20,000 or more based on the most recent decennial census of the United States.”

Proposed 8 C.F.R. 204.6(j)(6)(ii)(A): The DHS would continue to permit investors to provide evidence that the new commercial enterprise is principally doing business in an area that is (1) a metropolitan statistical area, (2) a specific county within a metropolitan statistical area, or (3) a county within a city or town with a population of 20,000 or more, that has experienced an average unemployment rate of at least 150 percent of the national average rate.” The DHS proposed adding to the list “cities and towns with a population of 20,000 or more.” The DHS explained that this proposal is based on its determination that it is appropriate to consider cities and towns that could independently qualify as TEAs if they meet the 150 percent unemployment threshold.

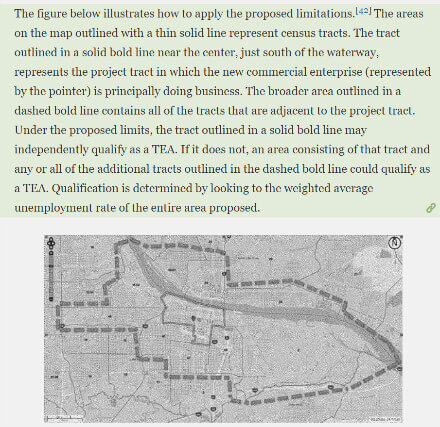

Proposed 8 C.F.R. 204.6(i): The DHS proposed a new rule for determining when a geographic or political subdivision could qualify as a TEA. Under current rules, states may make this determination on a case-by-case basis. The DHS proposed that it allow TEAs that consist of a census tract or contiguous census tracts in which the new commercial enterprise is principally doing business if the weighted average unemployment rate for such tract or tracts is at least 150 percent of the national average. Additionally, the new rule would allow a TEA designation “if the project tract(s) and any or all additional tract(s) comprise an area in which the weighted average of the unemployment rate for all of the included tracts is at least 150 percent of the national average.” In complying with this proposed rule, petitioners would be required to “submit a description of the boundaries of the geographic or political subdivision and the unemployment statistics in the area for which designation is sought … and the method or methods by which the unemployment statistics were obtained.”

Please see the below picture for a description taken straight from 82 FR 4749 regarding how 8 C.F.R. 204.6(i) would work:

[Click image to view full size]

The Notice of Proposed Rulemaking offered the following reasons for making the census tract “the building block for the geographic or political subdivisions:

1. Census tracts offer uniformity with regard to size.

2. Data at the census tract level is publicly available and is updated annually.

3. Census tract numbering is stable and generally only changes once every 10 years (at the time of the next available census).

4. Because local planning agencies can request changes to census tract configurations, the proposal would offer localities input in the overall process.

In conclusion, the DHS took the position that its limitation of TEAs “would remove the possibility of gerrymandering and better ensure that the reduced investment threshold is reserved for areas experiencing significantly higher levels of unemployment.”

F. Technical Changes (82 FR 4750-4751)

The DHS proposed several technical changes to other EB5 regulations. In the subsequent subsections, we will examine each of these changes.

1. Separate Filings for Derivatives

Under the current 8 C.F.R. 216.6(a)(1), derivatives of principle petitioners for EB5 immigrant investor status should generally be included on the principal’s Form I-829, Petition by Entrepreneur to Remove Conditions on Permanent Resident Status. However, there are circumstances when a derivative cannot be included on the principal investor’s Form I-829. The regulations are unclear as to whether multiple derivatives could be included on the same Form I-829 in the event of the death of the principal investor.

Accordingly, the DHS proposed clarifying the issue with a proposed regulation that would be codified at 8 C.F.R. 216.6(a)(1)(ii). The proposed rule would specify that when derivative EB5 beneficiaries could not be included on the principal’s Form I-829 due to the death of the principal, all dependents may be included on the same Form I-829. However, in all other situations, derivatives must file separate Forms I-829 where they were not included in the principal’s Form I-829 and the principal is not diseased.

2. Interviews

Under section 216A(c)(1)(B) of the INA, most Form I-829 petitioners are required to be interviewed before a final decision is rendered on the petition. However, the interview requirement may be waived at the discretion of the DHS in accord with section 216A(d)(3). Section 216A(d)(3) provides that the interview may be held at a location convenient for both parties. However, under the current 8 C.F.R. 216.6(b)(2), the DHS generally schedules interviews in the location of the commercial enterprise. This policy exists notwithstanding the fact that EB5 immigrant investors are not required to reside in the same location as the new commercial enterprise.

The DHS proposed amending 8 C.F.R. 216.6(b)(2) “to give stakeholders greater flexibility in the interview location by clarifying the [DHS’s] discretion under the INA to determine the appropriate location for Form I-829 petition interviews.” The new rule would allow for interviews to be scheduled at one of the USCIS office holding jurisdiction over:

1. The immigrant investor’s commercial enterprise;

2. The immigrant investor’s residence in the United States; or

3. The location where the Form I-829 is adjudicated.

The rule would promise to give petitioner’s more flexibility in scheduling Form I-829 interviews.

3. Process for Issuing Permanent Resident Cards

Under the current 8 C.F.R. 216.6(d)(1), after the approval of a Form I-829, immigrant investors and derivatives are required to report to a USCIS district office for processing of their permanent resident cards.

The DHS explains that due to improvements in biometric collection, this requirement is no longer necessary. Accordingly, the DHS proposed amending 8 C.F.R. 216.6(d)(1) to give the DHS discretionary authority to require an immigrant investor and/or derivatives thereof to report to a district office to provide biometric data. Under most circumstances, the DHS would be able to mail permanent resident cards after approval of the Form I-829 without the petitioner having to report to a district office.

4. Miscellaneous Other Changes

The DHS proposed several other miscellaneous changes to modernize the EB5 regulations.

The DHS proposed changing “United States Customs Service” to “U.S. Customs Border and Protection” in 8 C.F.R. 204.6(j)(2)(iii).

The DHS proposed removing references to “new commercial enterprise” in 8 C.F.R. 204.6 and 216.6 (this requirement no longer exists in statute).

The DHS proposed eliminating references to “management” in 8 C.F.R. 204.6(j)(5) and 8 C.F.R. 204.6(j)(5)(iii).

The DHS proposed amending 8 C.F.R. 204.6(k) to remove the requirement that USCIS specify in its decision whether the new commercial enterprise is principally doing business in a TEA.

The DHS proposed replacing the term “entrepreneur” with “investor” in portions of 8 C.F.R. 204.6 and 216.6.

The DHS proposed removing references to the “Form I-526” and “Form I-829” in 8 C.F.R. 204.6(a) and 216.6(a) and (b).

Finally, the DHS proposed replacing the word “deportation” with “removal” in 8 C.F.R. 216.6(a)(5) to bring the regulation up to date with the terminology used in the INA.

Conclusion

The notice of proposed rulemaking proposes what would be very significant changes to the EB5 program. Most notably, the proposed changes on the investment cap and the designation of TEAs would have an effect on all subsequent EB5 petitions. It is important to note that it is uncertain which proposals may make it into the final rule. It is also worth considering that the rule was proposed under the DHS of the previous administration, and the current administration may decide to go a different direction on some of the proposals. Finally, Congress has been debating changes to the EB5 program for years, and it remains possible that at some point in the near future it will reach an agreement as to certain statutory modifications of the EB5 program.

We will update the site with more information relating to the future of the EB5 program and any updates regarding the notice of proposed rulemaking.