- Introduction

- Factual and Procedural History

- Issue on Appeal

- Relevant Statute

- Analysis: Essential Function

- Analysis: Function Manager

- Five Points that Must Be Established to Demonstrate Beneficiary Will be Employed in “Managerial Capacity” as a “Function Manager”

- Applying the Law to the Specific Facts in the Instant Case

- Conclusion

Introduction

On November 8, 2017, the United States Citizenship and Immigration Services (USCIS) issued a policy memorandum (PM) (PM-602-0148) designating a decision of the Administrative Appeals Office (AAO) as an “adopted decision.” The decision, Matter of G- Inc., Adopted Decision 2017-05 (AAO Nov. 8, 2017), now constitutes binding policy guidance on all USCIS personnel [PDF version].

Matter of G- Inc. establishes rules for petitions for EB1C function managers. The AAO held that in order for a petitioner to establish that a beneficiary will manage an essential function, the petitioner must establish “that the function is a clearly defined activity and is core to the organization.” The AAO then held that once the petitioner demonstrates the essential function, the petitioner must then establish that the beneficiary’s position meets the statutory criteria set forth in section 101(a)(44)(A) of the Immigration and Nationality Act, which defines “managerial capacity.” First, the petitioner must show that the beneficiary will primarily manage, as opposed to perform, the specified function. Second, the petitioner must show that the beneficiary will “act at a senior level within the organizational hierarchy or with respect to the function manager. Finally, the petitioner must show that the beneficiary will “exercise discretion over the function’s day to day operations.”

In this article, we will examine the facts and procedural history of Matter of G- Inc., the AAO’s analysis and conclusions, and what the designation of the decision by the USCIS will mean for EB1C petitions going forward.

Please see our full selection of articles to learn more about the nonimmigrant category for intracompany transferee managers in L1 visas [see category] and L1A executives and managers [see category] in particular. To learn more about EB1 immigrant intracompany transferees and other forms of employment immigration, please see our category on the subject [see category].

Factual and Procedural History

The Petitioner in Matter of G- was a multinational technology-based development corporation. The Petitioner sought to employ a Beneficiary as its “Director, Financial Planning and Analysis (FP&A).” The Petitioner filed a Form I-140, Immigrant Petition for Alien Worker, seeking status for the Beneficiary under section 203(b)(1)(C) of the Immigration and Nationality Act (INA), which allows for a U.S. employer to transfer a qualifying foreign employee to the United States as an immigrant to work in an “executive or managerial capacity.” This provision is part of the employment-based first preference immigrant visa category (EB1C for intracompany transferee executives and managers). Specifically, the Petitioner submitted evidence to show that the Beneficiary would be a “function manager.”

The Director of the USCIS’s Nebraska Service Center denied the petition, concluding that the evidence submitted with the Form I-140 did not establish that the Petitioner would employ the Beneficiary in a managerial capacity. The petition was also denied on the basis that the Petitioner did not establish that it had been doing business in the United States for one year prior to the filing of the petition. The AAO rejected the second point in footnote 3 of its decision.

The Petitioner appealed from the denial of the Form I-140 to the AAO. In the appeal, the Petitioner noted that it had had employed the Beneficiary as an L1A nonimmigrant in a position with the same time as the position listed on the Form I-140 since 2013. The L1A nonimmigrant category is for nonimmigrant intracompany transferee executives and managers. On appeal, the Petitioner argued that the Nebraska Service Center Director both misstated facts and abused his discretion in denying the Form I-140.

Issue on Appeal

The AAO stated that on appeal, it would consider “whether the Petitioner established that the Beneficiary will be employed in a qualifying ‘managerial capacity’ as defined in the [INA]…” Specifically, the AAO would determine whether the evidence submitted by the Petitioner established that the Beneficiary would “primarily manage an ‘essential function’ within the organization.” The AAO stated that it would review the issues de novo, meaning from the beginning. In the forthcoming sections, we will examine the Board’s analysis and why it decided to sustain the Petitioner’s appeal.

Relevant Statute

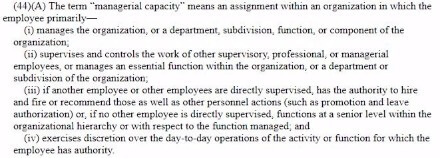

The relevant statute for the AAO’s analysis is found at section 101(a)(44)(A) of the INA, which defines the term “managerial capacity.” The term “managerial capacity” is used in section 203(b)(1)(C) of the INA, which is the section under which the Form I-140 in the instant case was filed. Section 101(a)(44)(A) reads as follows:

[Click image to view full size]

The AAO noted that by statute the term “managerial capacity” encompasses both “personnel managers” and “function managers.” This means that a petitioner can seek to employ an intracompany transferee manager in a position that would “manage” (as defined in section 101(a)(44)(A)) either personnel or a function of the organization. The instant case involves a petition for a “function manager.” The AAO explained that a “function manager” must primarily manage an “essential function” within the petitioning organization. The AAO addressed how to consider when an L1A beneficiary would manage an “essential function” in 2016 in Matter of Z-A-, Inc., Adopted Decision 2016-02 (AAO Apr. 14, 2016). Please see our full article on Matter of Z-A- to learn more [see article].

Analysis: Essential Function

The AAO noted that neither the statutes nor the implementing regulations define the term “essential function.” Accordingly, it looked to the dictionary for the definition of the terms. The AAO explained that “essential” means “necessary,” “core,” or “fundamental.” The AAO concluded that, in the context of section 101(a)(44)(A) of the INA, “function” refers to an “activity.” Accordingly, the AAO reasoned that “essential function” should be construed as “a core activity of an organization” (note that the AAO made clear in a footnote that an organization may have multiple core activities). It reasoned that this reading of the term was in accord with Congress’ purpose in creating the EB1C classification, which it described as being “to facilitate the transfer of key managers or executives within a multinational organization.”

The AAO explained that “[w]hether the function [that a beneficiary will manage] is sufficiently related to an organization’s core activity or activities is inherently one of degree…” The AAO explained that in filing a Form I-140 petition to afford EB1C preference, the petitioner must:

1. Describe with specificity the activity to be managed; and

2. Establish that the function is core to the organization.

In considering the petition, adjudicators must consider “all relevant facts.”

Analysis: Function Manager

The AAO explained that “[o]nce the petitioner demonstrates the essential function, it must then establish that the beneficiary’s position meets all the criterial for ‘managerial capacity’ as defined in [section] 101(a)(44)(A) of the [INA].”

In so doing, the petitioner has the burden of showing that the beneficiary will “primarily manage” the essential function. To do this, the petitioner must provide evidence describing the beneficiary’s duties and the proportion of time the beneficiary will dedicate to each duty. Although performing “some operational or administrative tasks” is not disqualifying, the evidence must establish that the beneficiary will primarily manage the essential function. In Matter of Church Scientology Int’l, 19 I&N Dec. 593, 604 (Comm’r 1988) [PDF version], a former Immigration and Naturalization Service (INS) Commissioner held that the duties of the employee must be primarily at a managerial and executive level, and that “an employee who primarily performs the tasks necessarily to produce a product or to provide services is not considered to be employed in a managerial or executive capacity.”

The petitioner is also required to establish both (1) “that the beneficiary will occupy a senior position in the petitioner’s organizational hierarchy” or (2) “within the function managed and that the beneficiary will have discretionary authority over the day-to-day operations of that function.”

In considering whether a petitioner meets the burden for showing that a beneficiary will be a function manager as defined in section 101(a)(44)(A), adjudicators must consider “all factors relevant to [the above] criteria.” The AAO listed several of the factors that must be considered:

The nature and scope of the petitioner’s business;

The organizational structure and staffing levels;

The value of the budgets, products, or services that the beneficiary will manage; and

Any other relevant factors that will contribute to understanding the beneficiary’s actual duties and role in the business.

Five Points that Must Be Established to Demonstrate Beneficiary Will be Employed in “Managerial Capacity” as a “Function Manager”

Following from these points, the AAO listed the five things that a petitioner must demonstrate in order to establish that the beneficiary will be employed in a “managerial capacity” as a “function manager”:

1. The function is a clearly defined activity;

2. The function is “essential”;

3. The beneficiary will primarily manage, as opposed to perform, the function;

4. The beneficiary will act at a senior level within the organizational hierarchy or with respect to the function managed; and

5. The beneficiary will exercise discretion over the function’s day-to-day operations.

Applying the Law to the Specific Facts in the Instant Case

The AAO next moved to apply the law it set forth in its analysis to the specific facts of the instant case.

First, the AAO assessed whether the evidence showed that the function in the case was a clearly defined activity. The AAO found that the Petitioner had sustained its burden. Firstly, it noted that the Petitioner had specified how “Financial Planning and Analysis” (FP&A) qualified as a “function,” noting that the evidence in the record substantiated that it was “a clearly defined activity that provides the Petitioner with financial strategies to optimize its business opportunities and growth.”

Second, the AAO found that the record also substantiated that FP&A was “essential” to the Petitioner’s organization. It explained that the FP&A’s revenue planning and forecasting process “impact[ed] every business unit and geographic area within the worldwide organization.” Furthermore, the reports generated by the FP&A were relied upon by the Petitioner’s executive team and board members. The AAO concluded that “[g]iven the scope of the Petitioner’s business, size, and international reach, we find that financial analysis and planning is core to the Petitioner’s business and therefore, it is an ‘essential’ function to this business.”

Third, the AAO found that the record demonstrated that the Beneficiary would primarily manage an essential function. It noted that the Beneficiary “primarily develops and directs revenue forecasts and analysis for the worldwide organization, leads mergers and acquisitions, and oversees strategic pricing analysis.” The Petitioner established that the Beneficiary would continue to work in this capacity if the Form I-140 were to be approved.

The AAO explained that, in order to complete revenue forecasts, the Beneficiary would “continue to direct the work of various teams across the Petitioner’s five business units and six geographic delivery areas…” The Petitioner submitted extensive evidence, “including organizational and workflow charts,” to demonstrate that “the Beneficiary leads an FP&A team that oversees the monthly revenue and forecast process and collects financial data from delivery leads and global sales teams.” Furthermore, the record demonstrated that the Beneficiary would “continue to be supported by six direct and three indirect reports.” With this support, the Beneficiary was enabled “to primarily develop policies and goals and oversee the execution of long-term strategies.” The structure allowed the Beneficiary “to primarily manage the FP&A function rather than perform it himself.” The AAO concluded that the fact that the Beneficiary supervised direct reports “does not detract from our finding that he primarily manages the function.”

Fourth, the AAO found that the record demonstrated that the Beneficiary would continue to act at a senior level within the Petitioner’s organization and with respect to the function managed, while noting that the Petitioner needed only to satisfy one of these points. It noted that the Beneficiary reported directly to the CFO and indirectly to the CEO in an organization with over 8,000 employees worldwide. In his capacity, he worked closely with other senior executives and managers.

Fifth and finally, the AAO concluded that the beneficiary would “continue to have significant discretionary authority over the day-to-day operations related to the FP&A function.” Firstly, the AAO noted that the Beneficiary established “policies and processes used by staff to provide the financial information necessary to drive the FP&A function…” Secondly, it noted that he would retain the discretionary authority “to identify, execute, and finalize mergers and acquisitions.”

For the foregoing reasons, the AAO concluded that the Petitioner successfully established that the Beneficiary would be employed as a function manager. Accordingly, it sustained the Petitioner’s appeal.

Conclusion

The new adopted decision adds clarity to the requirements for establishing that a beneficiary will be employed primarily in a “managerial capacity” as a “function manager.” Although the decision applies to an EB1C immigrant petition, the analysis is applicable to certain L1A petitions as well. In conjunction with the adopted decision in Matter of Z-A- from last year, the decision constitutes further guidance for EB1C and L1A “function managers.”

Due to the extensive rules and evidentiary requirements, petitioners seeking to transfer an employee from overseas to the United States should consult with an experienced immigration attorney for guidance. In addition to assisting in the petitioning process, an attorney may assess the facts of the specific case to determine which immigrant or nonimmigrant option is most appropriate.

Please see our directory on articles about AAO adopted decisions [see article] and BIA/Attorney General precedent decisions [see article].